Introduction

Every year the content might change from time to time, e.g remove futures and add options, remove forex and add bonds. But it generally stays the same.

Module Overview

IS423 teaches you about the technology and processes that are happening in financial services. You learn about things like bonds vs futures vs stocks, understand a little about bond pricing and how futures and OTC markets work, diff between quote and order driven markets, the current tech that is being used (how they are made up in terms of modules), and finally discuss about some future areas for growth.

This module took up less than 5h per week, less the project which took about 15-20h per week. The module is really chill, concepts are easy to understand.

Component Breakdown

- Quiz 1/Midterm (30%)

- Project (20%)

- Class Part (10%)

- Quiz 2/Finals (40%%)

Grade Breakdown

If you are aiming for A/A+, you will need to score well on all components. I scored well on all components. Finals did slightly above average.

If you are aiming for B+/A-, focus on quiz 1 and quiz 2.

General Strategy

Memory Techniques are the way to go for this module. I mainly used memory techniques to study.

It is also important to ask questions in class. There are quite alot of areas that could come out of the exam. This module is really more of pure memory work. Understanding helps alot in memory, but you will have to remember different architectures, the pros and cons of many things, what constitutes crypto etc. Memorising everything well should probably give you a good score for the quiz.

Quiz Strategy

Quiz wise, I had about 80 flashcards for Quiz1, and 160 flashcards for Quiz2. You can tell that the content for Wk7++ is almost double that of Wk1-6. Keep that in mind.

Do your flashcards early and try to memorise them well. The quiz is a mix of MCQ and open ended, and you can usually get by just by memorising the content (but the content is heavy!).

Project Strategy

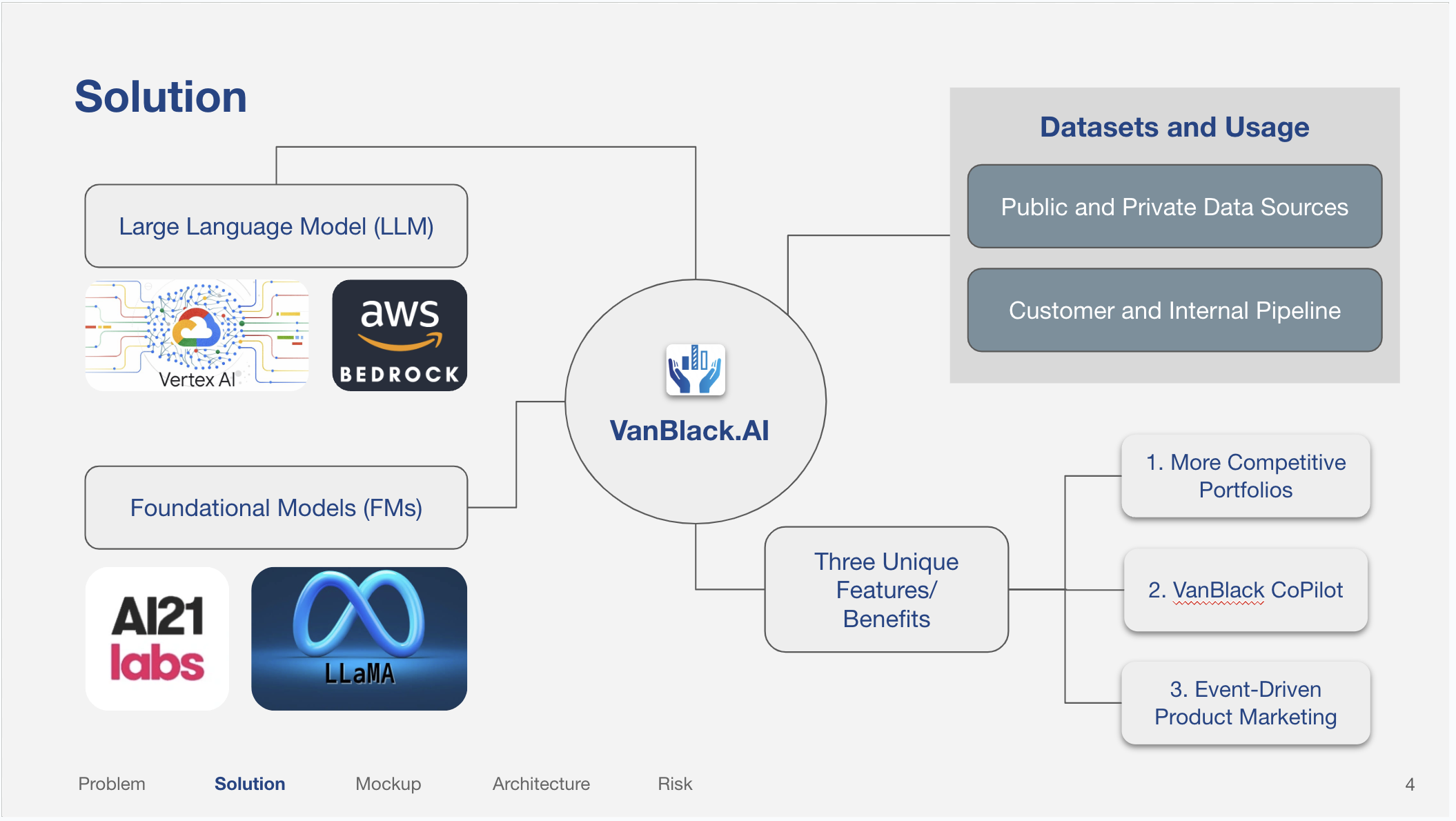

The project changes here and there. Mine was to write a proposal to introduce a new Gen AI Solution that would solve an issue, and compare how prev processes and the new process (with your solution), will change. The way to go about doing this is:

- Come up with a strong background context and problem statement. Your problem statement must be easily identifiable such that the prof instantly gets the problem during your presentation.

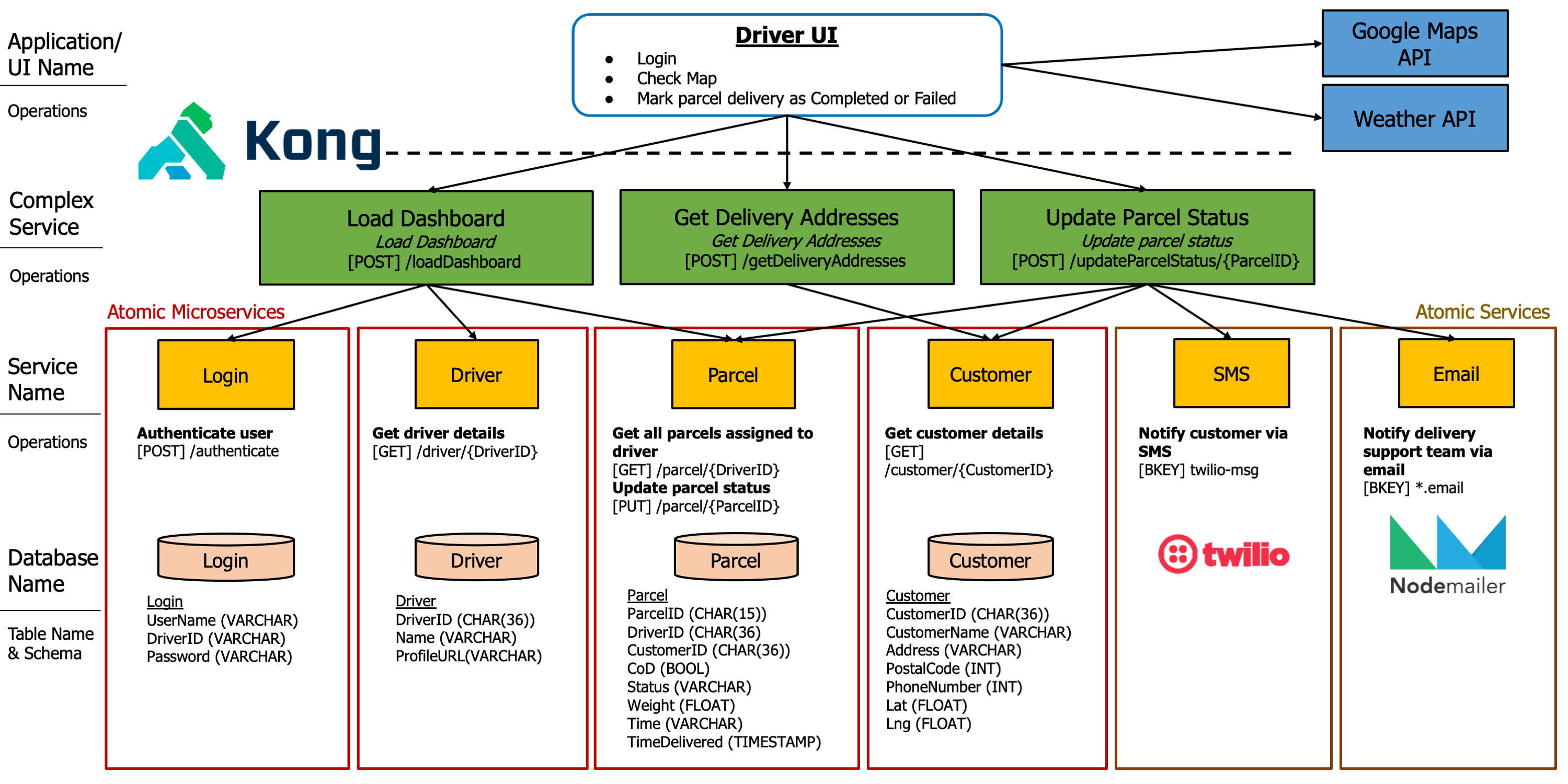

- Work on BPAS diagrams or As-Is and To-Be Architctures.

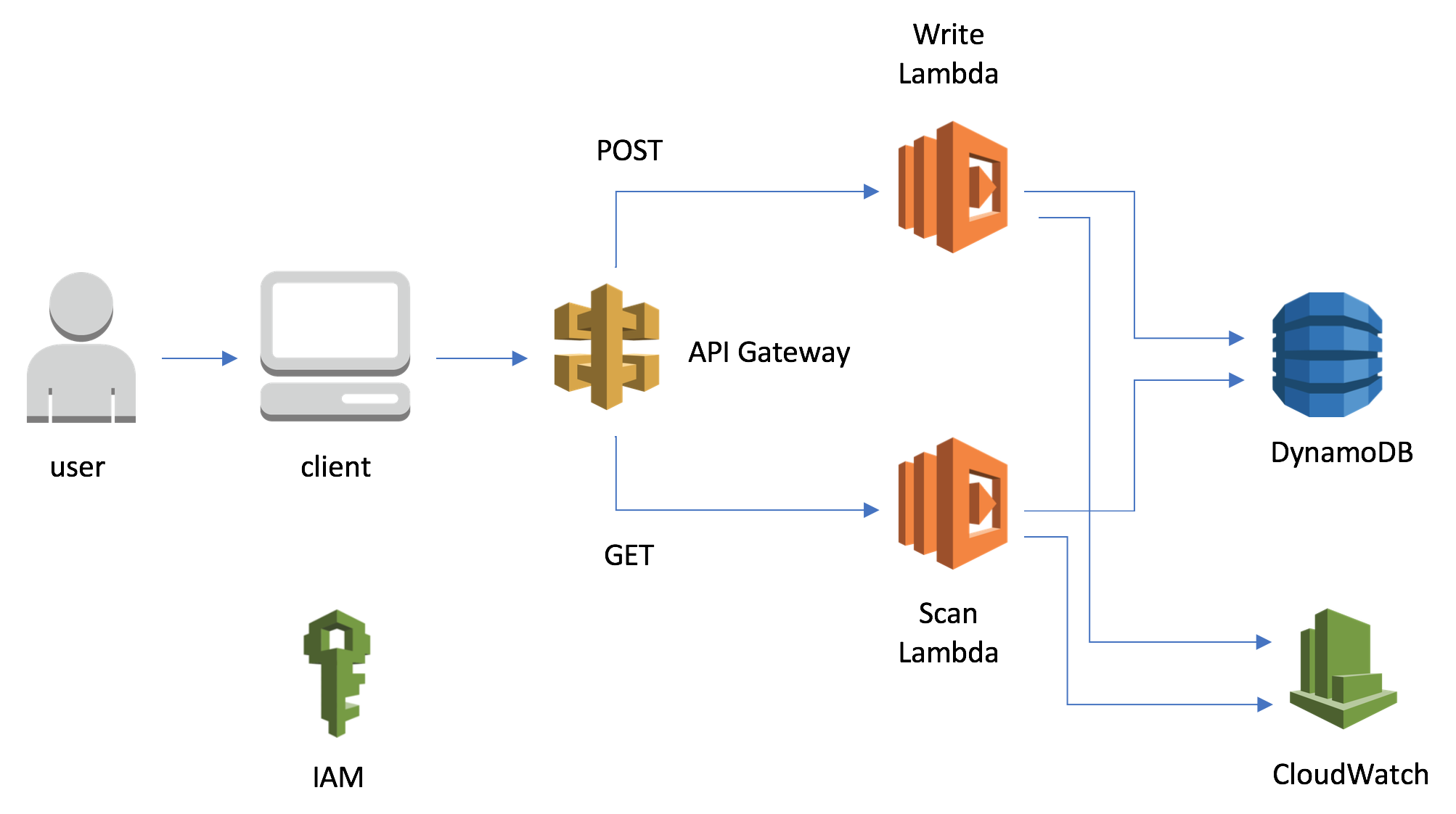

- Try to incorporate the architectures that were taught in class - there will be quite a number of architectures mentioned in class, and those must be memorised for the quizzes. Incorporating them into the project would also be ideal.

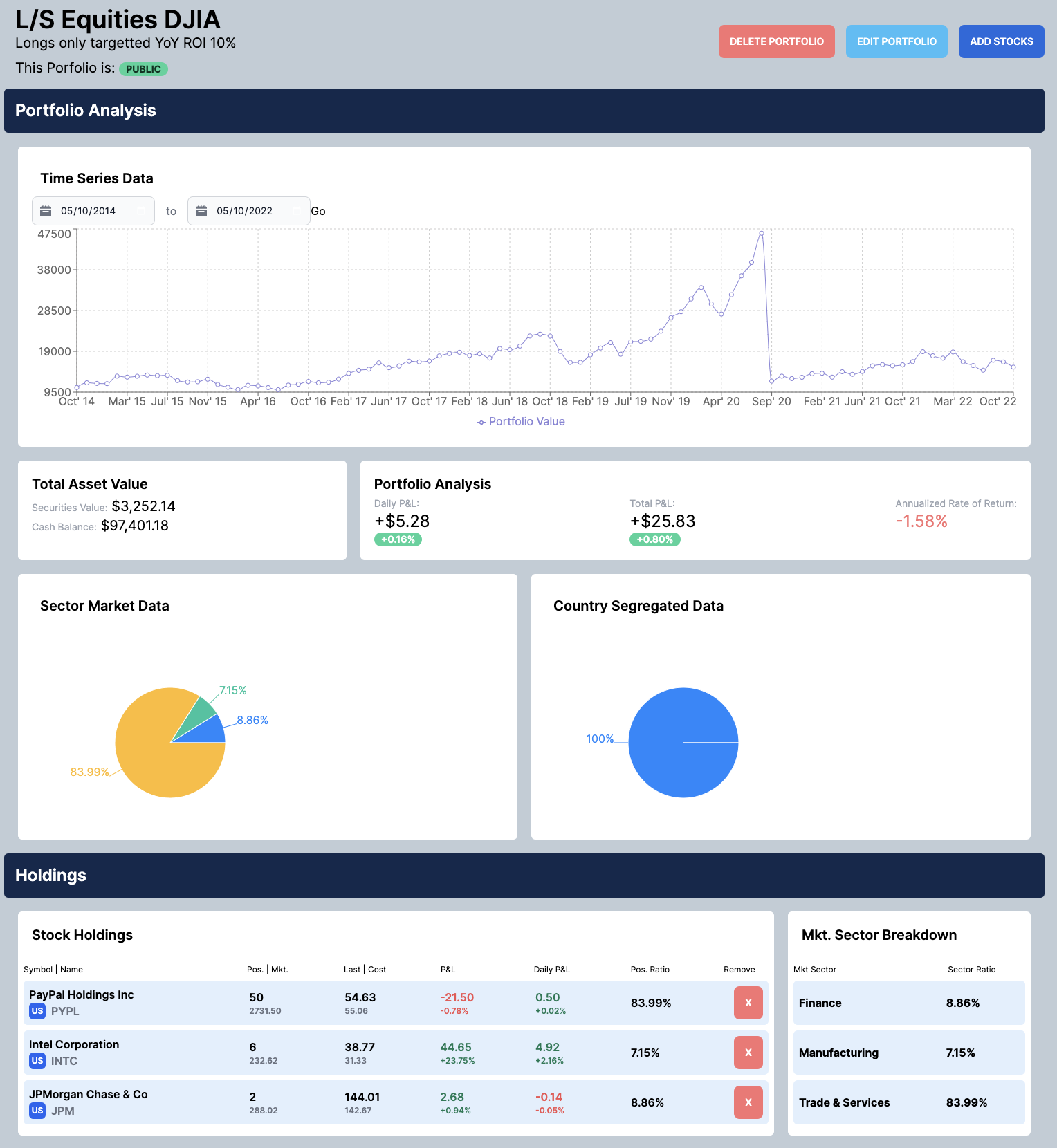

- Create a demo, Figma walkthrough is good enough. DO NOT USE LOREM IPSUM. Put some mock but ‘real’ data.

- Work on your risk assessment. Try to have 2-3 risks on the tech side, and the business side.

- Prepare for presentaton and rehearse 2-3 times.

The problem statement is really important. The target audience must be extremely clear. Show how the solution addresses the problem statement, show how the solution features come together to target the root cause of the problem.

Our solution:

The way to score really is to come up with (1) a cool solution that is unique and show very clearly how (2) it addresses a problem statement that is (3) pressing enough. Focus on 1-2, 3 if possible.

Class Part Strategy

Ask questions in class, remember to do the in-class labs and submit them as they are graded. Don’t do them anyhow, as you will get less CP points.

Conclusion

This is a great introduction to finance mod and you honestly cover a large chunk of finance + learning about technology in finance. The workload is really light. Project is done by Wk7, and if you bid with a good group, you can finish the proposal really really fast.

Prof is also very interesting and I would strongly recommend taking this module if you’re looking for a more fun and chill module. Content is heavy though (not hard to digest, just a lot) so you will need to study.

All the best!